Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

Definition Of A Default

By the virtue of you reading this page you have either been told first hand that you have a default or have heard about them causing issues with regard to obtaining credit. When you enter into a credit agreement with a lender a legal contract is formed between you as the borrower and the company advancing you the money or credit facility, the creditor.. In that contract you will have agreed to make certain payments to the creditor on a time line that you have pre agreed with them before you took our the loan, mortgage, revolving credit facility (such as a credit card) or any other type of finance. Your commitment within the contract and the implications of not keeping to it will vary quite dramatically based on the type of finance you have taken out, the lender you have borrowed from and how poor your conduct of the credit agreement is. If you fall significantly behind on your repayments, for example 4 or 5 months on a loan or credit card then the lender / creditor will possibly contact you and advise you that you have DEFAULTED on your contract with them and that they wish to seek full recovery of the money you still owe within a short time frame.

Your commitment within the contract and the implications of not keeping to it will vary quite dramatically based on the type of finance you have taken out, the lender you have borrowed from and how poor your conduct of the credit agreement is. If you fall significantly behind on your repayments, for example 4 or 5 months on a loan or credit card then the lender / creditor will possibly contact you and advise you that you have DEFAULTED on your contract with them and that they wish to seek full recovery of the money you still owe within a short time frame. How Do Companies Know That You Have A Default?

This is a very interesting and critically important aspect to understand with regard to your conduct of any sort of credit account, even things like car HP. You may have heard of credit reference agencies, but just in case you have not these are the companies who record an individual consumer`s conduct of their credit items. The main known ones are Equifax, Experian and Call Credit. Now to be able to record your credit performance the creditors, such as banks, building societies, mortgage providers etc pass information about your payments under the credit contract to the reference agencies. Just about all creditors do this and because they provide information into the reference arena then they are able to view other entries on a potential consumers credit file, provided they have your consent to do a ``credit search`` of course.

This is a very interesting and critically important aspect to understand with regard to your conduct of any sort of credit account, even things like car HP. You may have heard of credit reference agencies, but just in case you have not these are the companies who record an individual consumer`s conduct of their credit items. The main known ones are Equifax, Experian and Call Credit. Now to be able to record your credit performance the creditors, such as banks, building societies, mortgage providers etc pass information about your payments under the credit contract to the reference agencies. Just about all creditors do this and because they provide information into the reference arena then they are able to view other entries on a potential consumers credit file, provided they have your consent to do a ``credit search`` of course.Therefore once you are in default on a loan, mortgage or credit item the lender with pass that information onto the reference agency including matters such as how much you still owe to them and the date that you defaulted on the contract. So when you then go and apply for a loan, credit card, store card or even a bank account the company you approach will normally insist that you allow them to do a credit search on you to find out how you conduct your credit. They then see that you have a default and depending on their specific lending criteria they may refuse you. The default will often stay on your credit record for at least 4 years. You can of course try to make reparations, one way to do this is to contact the creditor in question, establish a settlement figure and pay that sum to them with an agreement that they will show the default as satisfied so long as it is still on your credit record until it drops off. That at least will mitigate the damage.

Not Aware Of Any Default But Advised When Refused I Have One

As we all know technology is not perfect and mistakes inevitably can and will happen. If you are refused credit and are told it is because of defaults think about what credit commitments you have had over the last 10 years. Things to consider are:- Did you perhaps take out a joint current account with an overdraft with a now ex-partner and are not aware of its current conduct? Joint borrowers take joint risks when it comes to credit

- Have you had issues at a previous address or that you thought were resolved but did not get final correspondence and therefore do not know if any damage was or is being done to your credit record

- Do you have the same name as someone else in your house or who used to live in your house? This is unlikely to cause issues as credit is related to your name, address and date of birth so difficult to confuse but it is a slim possibility

- Have you been a guarantor for a loan that someone else took out, if so if they fall behind and you do not meet the repayments for them on time then your credit file is affected and a default could be registered.

- Could you be a victim of financial crime? Have you received letters talking about cards or loans that you have never taken out. In this instance you will need to get the police involved as well as dealing with all the creditors who have been used by the fraudster

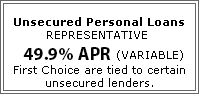

Unsecured Personal Loans |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential